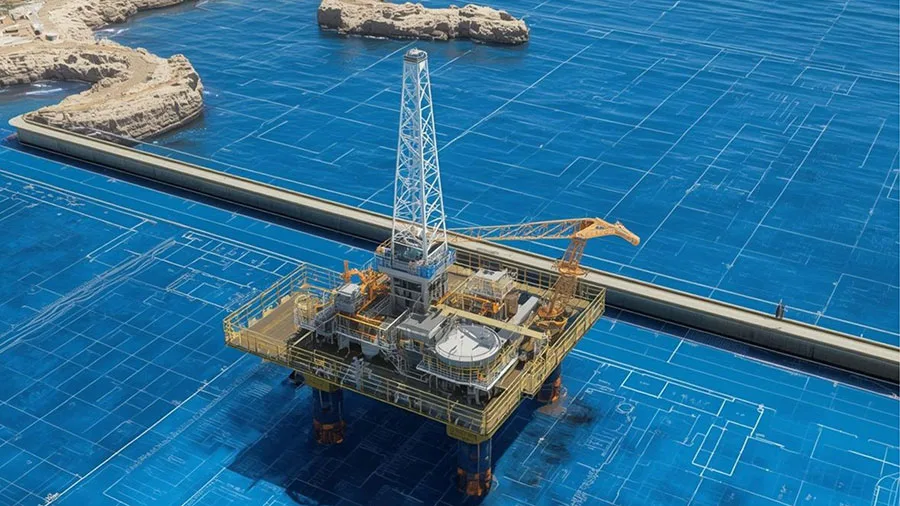

Drilling delayed in Bedout area, which hosts the large Dorado discovery

Santos’ highly-anticipated next round of offshore exploration drilling in the Bedout sub-basin offshore Western Australia has been pushed back to the first half of 2027, according to joint venture partner Carnarvon Energy.

The Bedout sub-basin is the most exciting new offshore exploration play in Australia, and has delivered the large Dorado oil and gas discovery, as well as the Pavo, Roc and other finds.

Carnarvon at its annual general meeting on Friday said that the joint venture aims to contract a drilling rig in 2026.

The “lack of rig availability through 2026” has pushed back the drilling timeline to the first half of 2027, Carnarvon chairman Robert Black said at the AGM. Nonetheless, he assured shareholders that the joint venture has began procurement of long lead items for the exploration campaign.

The public consultation on the environment plan for multiple well locations has already commenced, he added.

The Santos-led Bedout joint venture holds four exploration permits, WA-435-P, WA-436-P, WA-437-P and WA-438-P, over an area encompassing over 11,000 square kilometres. Carnarvon’s net best estimate contingent discovered resources in the Bedout sub-basin acreage are 54 million barrels of oil equivalent, the company recently revealed.

The joint venture partners are operator Santos with 80%, Carnarvon on 10% and OPIC Australia, a subsidiary of Taiwan’s CPC, also having 10%.

Exploration drilling was initially planned to commence in the middle of 2026 following the completion of the Bedout Mega Merge Project seismic surveys in July.

In its latest update, Carnarvon noted the first well is now expected to be spudded in the first half of 2027, subject to government and joint venture approvals. Further drilling is also planned for 2028-2029.

The 2027 drilling campaign is planned to target the Northern play fairway, which Carnarvon said hosts the largest identified prospects within the basin. The company added that the drill campaign will test the same play system as Dorado, and potentially new play types.

Survey results from the Mega Merge project are under evaluation for the finalisation of the exploration targets, as well as to guide the future exploration strategy, the company said.

The enhanced seismic dataset has enabled the identification of previously undetected structural features and stratigraphic trends, enriching understanding of the region’s geological potential, noted Carnarvon.

Santos’ decision in January to not proceed with the purchase of a floating production, storage and offloading vessel for the Dorado Phase 1 liquids project was a major disappointment for Carnarvon and drove the company’s strategic diversification by investing in onshore basin operator, Strike Energy.

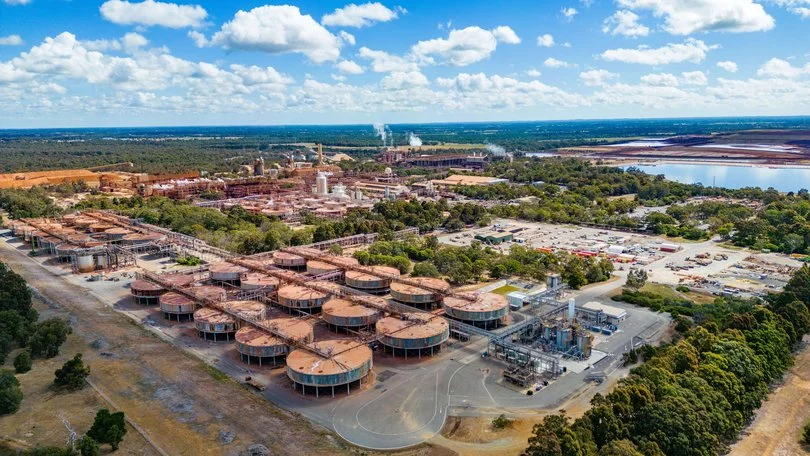

Carnarvon launched a A$86 million (US$56 million) investment in Strike Energy for a 19.9% shareholding, becoming Strike’s largest investor and increasing exposure to Western Australia gas markets.

Carnarvon chief executive Philip Huizenga noted that “the partnership positions Carnarvon as Strike’s largest shareholder and provides the required funding for Strike to unlock its high-quality Perth Basin assets, including South Erregulla and West Erregulla”.

“Your company news doesn’t just get published – it’s seen by the decision makers who matter.”