- Australian Oil Company acquires three petroleum leases and one petroleum pipeline lease in the Surat Basin

- Leases include producing Emu Apple oil field that has potential for substantial output boost

- Riverslea oil and Major gas fields could also be brought back into production at modest cost

Special Report: Australian Oil Company is expanding beyond its producing gas assets in California with the acquisition of strategic assets in Queensland’s Surat Basin that add production and growth opportunities.

The company signed binding agreements with ADZ Energy and OGT Energy to acquire three petroleum leases and one petroleum pipeline licence to the west of the Taroom Trough.

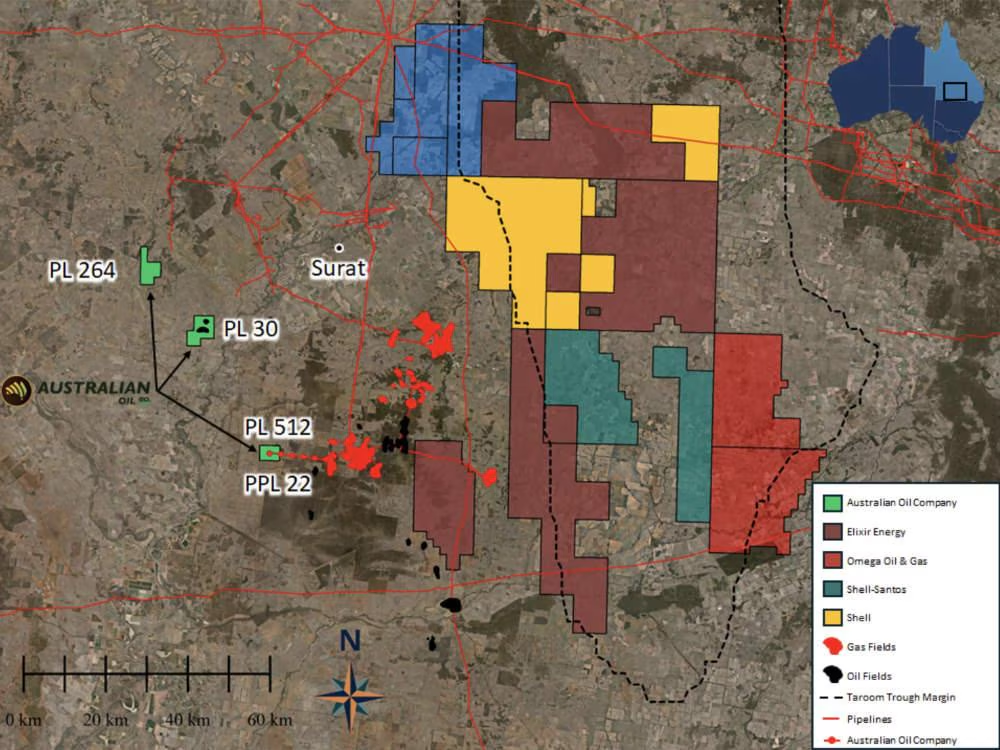

These consist of PL 264, which includes the producing Emu Apple oil field, PL 30 that hosts the Riverslea oil field, PL 512 that includes the Major gas field and PPL 22, which covers the pipeline and associated easements from PL 512 to the Silver Springs gas plant.

Adding interest for Australian Oil Company, the assets are close to the town of Surat, major gas gathering and processing infrastructure, and promising unconventional gas acreage held by Shell, Santos, Elixir Energy and Omega Oil & Gas in the Taroom Trough.

This comes on the back of the company moving to increase working interests in its Sacramento Basin, California, assets by reaching a binding agreement to acquire Xstate Resources’ interests earlier this month.

“These opportunities align directly with our strategy to broaden our exploration portfolio and increase our exposure to quality assets,” managing director Kane Marshall said.

“The licences sit in a robust jurisdiction with active nearby operators, and they offer a mix of exploration potential, near term development and production optimisation for both oil and gas.

“We now have a clear line of sight to commercial pathways for both commodities, supported by a range of opportunities that will appeal to different investor groups.

“We look forward to advancing these assets, maturing exploration drilling targets, strengthening our production profile, and building positive momentum into 2026.”

Australian assets

Most of the tenements covered by the acquisition were originally held by Origin Energy (ASX:ORG) prior to being acquired by Armour Energy before they were picked up by ADZ when Armour went into receivership.

The minority interests in PL 512, PL 30 and PPL 22 held by OGT were previously held by AGL Energy.

A consequence of these assets being held by major companies is that very little new work incorporating new geological understandings has been carried out on them.

However, this presents AOK with the opportunity to really investigate the undrilled prospects and leads within each licence.

One notable opportunity is the potential to increase oil production from the Emu Apple oil field from the current 15 barrels per day (bpd) to 50bpd.

AOK will also examine the potential to bring the Riverslea and Major fields back into production alongside new discoveries at modest costs as the facilities are in good condition.

The strategic infrastructure is also well placed to take advantage of nearby ground floor opportunities as most of the surrounding adjacent acreage is vacant.

PL 512 is also well positioned to address undersupplied gas markets through further gas exploration and development or gas storage opportunities.

This is highlighted by APA Group’s recent deal to jointly develop the proposed Brigalow peaking power gas plant with CS Energy.

Oil opportunities can also be developed quicker and at lower costs compared to other jurisdictions in Australia due to the existing infrastructure and proximity to the Inland Oil Refinery.

ADZ will receive a wellhead royalty of 2% on their 100% interest in PL 264, 90% interest in PL 30, and 84% interest in PL 512 (and any gas flowing through PPL 22).

OGT will receive $1 for their 10% interests in the four licences as incentive for the company to process and sell gas from PL 512 through agreed terms into OGT’s Silver Springs plant.

“When you share your news through OGV, you’re not just getting coverage – you’re getting endorsed by the energy sector’s most trusted voice.”