The energy transition is reshaping global markets, forcing corporations to balance fossil fuel investments with decarbonization imperatives. Alcoa’s $30 million investment in Western Australia’s Equus Gas Project, operated by Hess Corporation, sits at the intersection of these competing priorities. While the project’s pause due to low oil prices raises questions about its short-term viability, its long-term alignment with energy transition goals and ESG frameworks warrants closer scrutiny. This analysis evaluates the strategic implications of Alcoa’s stake, focusing on its potential to deliver high-impact ESG returns and contribute to a low-carbon energy future.

Energy Transition Context and Project Overview

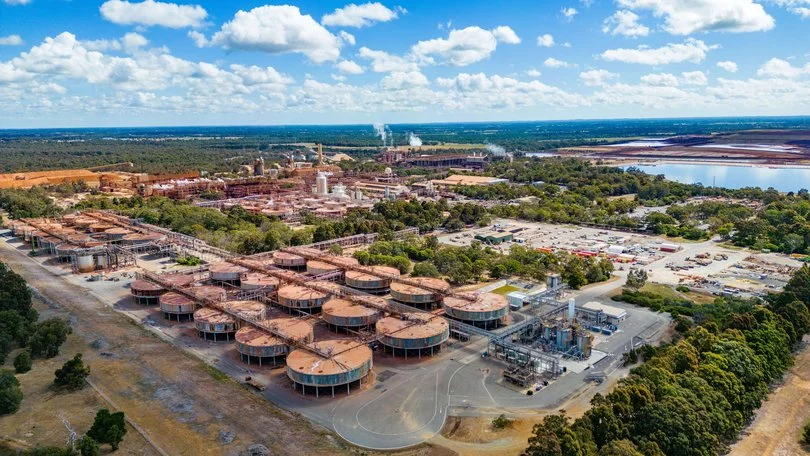

The Equus Gas Project, located 200km northwest of Onslow in the Carnarvon Basin, holds 2 trillion cubic feet of gas and 42 million barrels of condensate. Its development plan includes a Floating Production, Storage, and Offtake (FPSO) facility to process gas for domestic supply and LNG export, with operations slated to begin in mid-2027 [1]. However, Hess placed the project on hold in 2017 due to prolonged low oil prices, leading to office closures and workforce reductions [1]. This delay underscores the volatility of fossil fuel projects in a market increasingly influenced by climate policy and investor pressure.

Alcoa, a major Western Australian gas consumer, has historically invested in gas infrastructure, including a 2015 $40 million deal with Buru Energy [2]. Its recent $30 million stake in Equus reflects a strategic pivot toward securing stable energy supplies while navigating ESG expectations. The project’s potential to supply gas for both domestic use and LNG export positions it as a transitional asset in Australia’s energy mix, where natural gas is often framed as a “bridge fuel” to renewables.

ESG Alignment and Industry Trends

While specific ESG metrics for the Equus project remain undisclosed, broader corporate trends suggest Alcoa is likely aligning its investment with global sustainability frameworks. Fortune 500 companies, including energy firms, are increasingly adopting the United Nations Sustainable Development Goals (SDGs) and the Global Reporting Initiative (GRI) to structure sustainability reporting [3]. These frameworks emphasize transparency in emissions reporting, renewable energy integration, and community engagement—areas where the Equus project could demonstrate progress.

For instance, Hess has allocated over $1.8 billion since 2007 to environmental studies and sustainable development for Equus [1]. This includes measures to mitigate ecological impacts in the Carnarvon Basin, a region with sensitive marine ecosystems. While such efforts are commendable, the project’s reliance on natural gas—a fossil fuel with methane leakage risks—poses challenges for full alignment with net-zero goals. Alcoa’s ESG strategy must therefore address these trade-offs, potentially through carbon capture technologies or offset programs.

Strategic Implications for ESG Markets

The Equus project’s success hinges on its ability to balance economic returns with environmental accountability. For investors, this means evaluating whether Alcoa’s stake can generate ESG returns through measurable outcomes such as reduced flaring, methane capture, or community investment. The project’s $30 million investment could fund innovations like digital monitoring systems to track emissions or partnerships with renewable energy developers to blend hydrogen into gas pipelines—a practice gaining traction in Australia [4].

Moreover, Alcoa’s involvement may signal a broader industry shift. As noted in corporate sustainability reports, companies are embedding ESG principles into leadership structures and operational decisions [3]. By aligning with frameworks like the Science-Based Targets initiative (SBTi), Alcoa could position Equus as a model for responsible gas development. This would not only enhance its reputation but also attract ESG-focused capital, which now accounts for over 30% of global assets under management [5].

Risks and Mitigation

Critics argue that gas projects like Equus risk locking in carbon-intensive infrastructure for decades, conflicting with the International Energy Agency’s (IEA) net-zero roadmap. However, proponents counter that natural gas can support renewable integration by providing grid stability during the transition. Alcoa must navigate this debate by ensuring the project adheres to strict emissions thresholds and complies with evolving regulations, such as Australia’s proposed methane pricing mechanisms.

Conclusion

Alcoa’s $30 million investment in the Equus Gas Project represents a calculated bet on the dual imperatives of energy security and ESG compliance. While the project’s pause highlights the financial risks of fossil fuel ventures, its potential to align with global sustainability frameworks offers a pathway to high-impact ESG returns. For investors, the key will be monitoring Alcoa’s ability to integrate decarbonization technologies, transparently report progress, and adapt to regulatory shifts. In a market where ESG performance increasingly dictates capital flows, the Equus project could either exemplify a transitional strategy or underscore the challenges of reconciling fossil fuels with a net-zero future.